Apps on the bestai4you.com website are sourced from the App Store and Google Play, then edited and edited by our team. If you are interested in the Apps on our website, you can download them through the recommended download links. If there is any infringement, please contact us.

Apps on the bestai4you.com website are sourced from the App Store and Google Play, then edited and edited by our team. If you are interested in the Apps on our website, you can download them through the recommended download links. If there is any infringement, please contact us.

Zelle is a real-time payment application jointly developed by multiple large US banks. Its application description can be summarized from the following aspects:

1、 Core functions

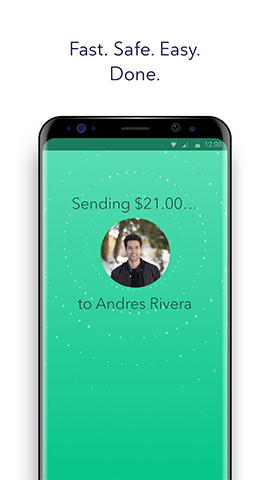

Real time payment: Zelle's core function is to provide real-time transfer services, where users can transfer funds to trusted individuals or merchants within minutes, and the funds are directly deposited into their bank accounts.

Cross bank transfer: As a built-in transfer system for most US banks, Zelle supports real-time transfers between different banks and usually does not require payment of transaction fees.

2、 Convenience of use

Integrated into banking applications: Zelle is embedded in many mobile applications of Bank of America, and users can use it without additional downloads, making it easy to operate.

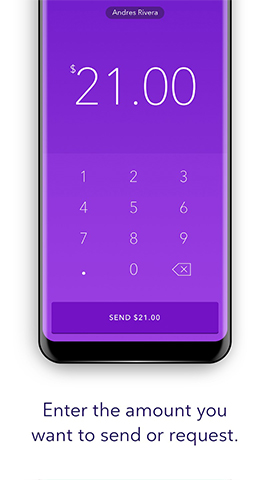

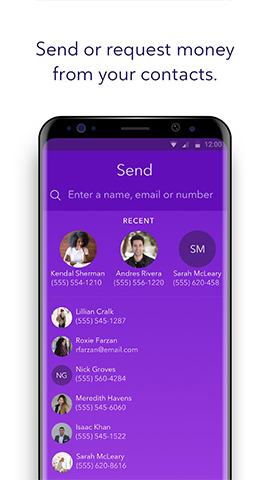

Simple operation: Users only need to tap a few times on their mobile phones, enter the recipient's email address or US phone number and transfer amount to complete the transfer.

Wide coverage: Due to the involvement of multiple banks, Zelle has a wide user base, making it easy for users to conduct financial transactions with friends, family, and businesses.

3、 Security

Bank level security: Zelle adopts bank level security mechanisms, including advanced encryption technology and multiple verification methods, to ensure the security of users' transaction information and funds.

Irreversible transaction: Once the transfer is completed, the funds will be directly deposited into the other party's bank account, which is usually irrevocable, thus improving the security of the transaction to a certain extent.

4、 Application scenarios

Personal transfer: Zelle is commonly used for instant transfers between individuals, such as sharing bills, paying service fees, or transferring money to family and friends.

Merchant payment: With the popularity of Zelle, more and more merchants are also accepting Zelle payment, such as retail stores, online markets, etc., providing users with more payment options.

5、 Other characteristics

No chargeback: Once Zelle transfer is completed, the bank does not support unjustified withdrawal of payment, which helps reduce transaction disputes.

Order processing: For online merchants, Zelle's online payment interface provides high success rate order processing services, with a 100% success rate for order creation and typically high payment success rates.

In summary, Zelle, as a real-time payment application, has won the favor of a large number of users with its fast, convenient, and secure features, and plays an important role in personal transfers and merchant payments.